The Close process is common to all organisations and covers the period end close of the ERP or finance systems. Financial consolidation is the process of combining financial data from several departments or business entities within an organisation, usually for reporting purposes. Today’s finance teams need to be ready to handle a multiple of requirements and demands such as; the oversight of financial transactions, management of enterprise performance, accurate financial reporting, and timely financial close and consolidation process. Along with trying to achieve efficiency and accuracy throughout this process, Chief Financial Officers (CFOs) are aiming for improved financial governance, increased transparency and reliability of data.

Here we delve into how a CFO can approach these challenges. There are elements of this process which fall outside of the scope of this article which we will cover in passing with some general thoughts.

ERP Close

This is the part that may well differ from one organisation to another. Much of this will depend on your industry and the sophistication of the underlying ERP as well as the desire for information by senior executives. Some observations that we would make are:

- Implementing a group-wide ERP solution should be very carefully considered. Whilst it is a laudable objective, the business case for doing so needs to be strong as it will be a long and expensive exercise. If you are trying to achieve standardised reporting then there are quicker and cheaper ways of doing this e.g. using an overlaying consolidation software (more on this later).

- There needs to be discipline around period end close that is agreed and adhered to. If this is not the case then subsequent reporting steps can be compromised i.e. prior period adjustments.

- Many organisations spend too long being “exactly wrong” rather than “roughly right”. By this I mean that some accountants want to accrue to the nearest penny thus slowing the period end close. A sensible level of materiality should be agreed.

- You do not need to get your ERPs perfect before implementing a consolidation solution nor is it absolutely necessary to implement a new ERP before implementing a consolidation solution. In fact, we would recommend implementing a consolidation/reporting solution first as this surfaces the information needs of the organisation which may in turn drive the requirements of the ERP or, more certainly, the ‘Chart of Accounts’ design.

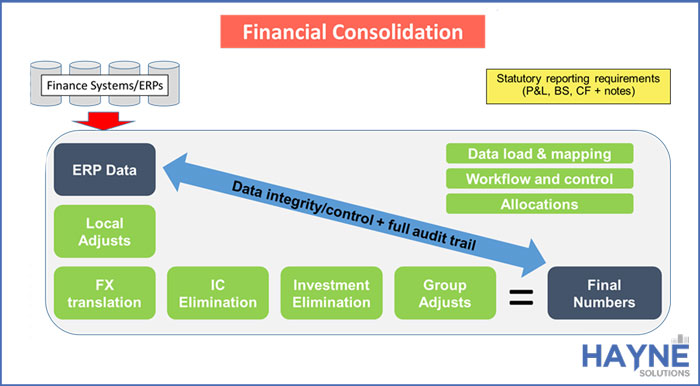

Consolidate

Most organisations of a significant size are likely to have multiple legal entities and, therefore, financial consolidation on a periodic basis will be a significant process. Whilst simple consolidation can be modelled within spreadsheets, when a certain level of complexity is reached, this methodology quickly becomes incapable of dealing with the needs of the organisation.

What you should be looking to achieve is a process that has the following characteristics as a minimum:

- When the ERP is closed, there should be an automated process to extract and upload data to the consolidation solution (in local currency). Ideally, this should preclude users from modifying data to ensure integrity.

- Data should be capable of being “mapped” to a Group Chart of Accounts – allowing disparate ERPs to be maintained.

- Elimination of intercompany balances should be an automated process.

- Elimination of investments (and other related entries) should be an automated process.

- Journal capability to enable “Group” adjustments (see note below).

- FX translation to a Group reporting currency (with various different rates; historic, average, closing, opening etc.).

- Consolidation of values at a Group and Sub-Group level.

- Data integrity checks (e.g. TB balances to zero).

- Full audit trail (see note below).

- Security functionality by capability and area (e.g. company).

Capable of collecting Notes to the Accounts and other non-financial data alongside standard P&L and Balance Sheet data.

Other characteristics that are optional may include:

- Multiple dimensions (e.g. Cost Centres, Departments)

- Profit in stock elimination

- Allocations

- Translation to any currency (as well as the top level company)

- Workflow allowing Group visibility of progress

- Time-stamped dimensions (see note below)

- Automatic calculation of indirect cash flow

- Drill to transactional details

In our opinion, any consolidation solution should be owned and managed by the finance team, not IT! This is a critical point that is often overlooked. The result of this should be that finance are responsible for, and can undertake, day-to-day maintenance without assistance.

So what does a ‘best-in-class’ financial consolidation process look like?

This will obviously differ slightly be organisation but an outline template would be as follows:

The detail behind this is as follows:

At subsidiary level:

- Make adjustments in ERP and hard close

- Load data to the consolidation solution

- Add additional information either automatically or manually (e.g. headcount, notes to accounts)

- Perform inter-company agreement process

- Make local adjustments (e.g. to conform with UK GAAP)

- Validate data against pre-defined group criteria (e.g. TB balances to zero, opening balances agree)

- Subsidiary signs-off data as complete

At group:

- Set-up for period (FX rates, opening balances etc.)

- Monitor subsidiary progress through workflow

- Raise group journals

- Run “consolidation” process (translate, eliminate, consolidate)

- Validate data against pre-defined group criteria (e.g. TB balances to zero, opening balances agree)

- Sign-off and lock data to ensure no changes are made

- Either run reports and distribute to users or allow access for self-service reporting

Points to note/ consider:

- Be very wary of ERP vendors who purport to do financial consolidation within their solution. More often than not (unless you have a single currency) they do not consolidate, they merely aggregate. This may fall far short of all your needs and should be carefully assessed.

- A full audit trail should be visible form ERP values through to final reported numbers. This will allow auditors to verify directly to the ERP and validate all consolidated adjustments.[This should extend down to individual data changes as well as master data changes].

- If inter-company agreement is a critical process to you, this may require a higher level of attention. This may include collecting transaction currency values as well as local currency values and a separate IC agreement sub-process prior to ERP close.

- Where possible journal entries should be limited to “group” adjustments and not used to correct ERP data (which should be corrected in the ERP and re-uploaded to maintain audit trail).

- Most enterprise consolidation solutions will require a consolidation process to be run to perform FX translation, elimination and consolidation (calculation of Group values). Be aware of solutions that offer “real-time” consolidation (often OLAP based) as this can create issues with “time-stamping” of results.

- Many organisations will want to “time-stamp” consolidations especially where this relates to statutory reporting e.g. where companies move within the Group. This may differ for “management reporting” that you may require to change history for comparison purposes.

- Supplementary information is critical to the period end process and may be sourced from another system (e.g. head count) or be input manually. An example of this could be notes to the accounts such as fixed asset movements. This level of detail is often found within the transaction detail and may require “manual” extraction.

- Automated indirect cash flow is often a requirement that would be driven by information in the notes to the accounts. This should be calculated within the solution thus giving cash flow at all levels of company and consolidation.

- Most consolidation solutions work on a YTD basis which, if you think about it, is logical. This takes away the issue of prior period adjustments that can plague some organisations.

- Drilling to transactional details is often stated as a requirement. We would recommend that you carefully consider whether this is really necessary as it can lead to added complexity and is seldom used to a justifiable level. For example, you may wish to only have transactional details for certain areas of interest.

- Financial consolidation relates to both actuals, budgets and forecasts.

A robust and efficient Financial consolidation process is the foundation to everything that follows and often forms the basis of phase 1 of a successful, integrated CPM/FPM implementation. There are a number of reasons for this, such as the fact that it is often the most mature process and one that can be modelled/automated the easiest.

Ready to start your journey towards Finance Nirvana?

- Articles to read

• Guide to Financial Budgeting, Planning & Forecasting

• Guide to Financial Analysis, Insight, Reporting & Disclosure

2. Contact us for an informal chat