How does your budgeting and forecasting process compare to other organisations?

How do you know what stage you’re at?

How do you move to that next stage and more importantly – what even is the next stage?!

Having been involved at the coalface when working as a Group Financial Controller and CFO, I have felt the pain and pressure of the budgeting, planning and forecasting (BP&F) process first hand. Working with many organisations in the past 15 years has also provided me with a wide range of experiences.

In our recent whitepaper ‘The Changing Role of the Finance Team’ we mention how you can create more time and add more value to the business. This article specifically looks at the BP&F process and the different levels of maturity that we have experienced. The objective is to provide you with a benchmark for your organisation. It draws on the HAYNE team’s personal experiences working as finance professionals helping organisations transform their (often painful) BP&F cycles.

The reality of BP&F in most organisations

The finance team understand the importance of budgeting as a basis for financial stability over the upcoming period; typically a year. Outside the finance team, it is often seen as a finance-driven burden done at such a high level and low frequency that it is largely disconnected from their day-to-day operational activity. Worse still it can be seen as ‘policing’. Worst of all, when finance genuinely try to engage with the business to understand the drivers it can be perceived as ‘snooping’.

Business users need to forecast and predict future business performance as well as understand the drivers of past performance. Improvements in the BP&F process can yield significant benefits and provide you with the tools to out-perform your competitors. Given all these accepted facts, why is it that the BP&F process within most organisations are in need of attention?

In our opinion there are two elements to a BP&F process that provide an indication of its maturity.

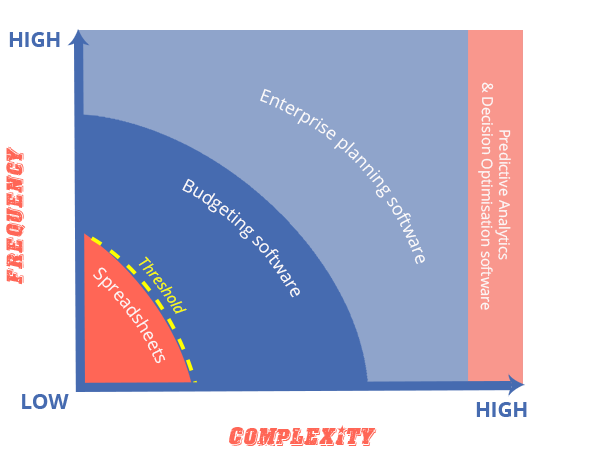

This chart shows that as frequency increases with complexity, the need for an appropriate technology becomes increasingly important.

Where are you on this chart? Where do you want to be?

Frequency

As the title suggests, this is the frequency at which the process is performed. The lowest level starting point is an Annual process, where there is one budget process covering the upcoming year, carried out as that year approaches.

This approach is sufficient for a business which has a limited number of variables. Month on month there is unlikely to be much financial change unless there is substantial operational change. One of the many weaknesses of this approach is that as the year progresses the finance team spend more and more time explaining ever growing variances, often repeating the same narrative month after month. This leads to a concentration on the past rather than the future.

Most organisations seem to operate in the next two categories, Annual + quarterly reforecast or Annual + monthly reforecast or a similar structure which does take account of change as the year progresses. This does focus the mind on the future but, like all annual based processes, the outlook reduces in time as the year progresses, to the point where the forecast is only looking two or three months forward. For nearly all companies this does not reflect the operational needs of the business.

The nirvana and acknowledged best practice for most organisations is a Rolling forecast which, for example, looks 12 months forward (or a period that covers the operation needs of the organisation). This overcomes the weakness of the annual based processes.

Complexity

The other variable in the BP&F process is complexity which can be described as the depth of connectivity, information and collaboration. The most basic level is what we describe as a Financial P&L which is the production of a P&L with no connected details or drivers. For example, turnover = £1,000 with no breakdown of how this is calculated. One step beyond this is the Financial P&L and funds flow where the data collected is developed to include a rudimentary (sometimes derived) cash flow.

The reality is in both these examples the details behind the financial numbers are normally found in ‘disconnected’ spreadsheets or systems. In our experience this occurs because of ‘history’ and ‘culture’. By ‘history’ we mean that “it has always been this way”. At the outset of the business the Finance Director built the budget and asked the other Directors for the numbers he needed to populate it. As the business has grown the Financial Controller now asks the Operations Director for the numbers, otherwise the process remains unchanged. By ‘culture’ we mean that “operations prefer not to give us any more detail”. If Finance has sought to build out the BP&F to connect P&L lines to details held within operations’ spreadsheets it has been resisted. There are many reasons for this, ranging from ‘gaming’ to genuine time pressures and perceived lack of benefit to themselves.

Where complexity starts to increase is what we describe as Low level connected where the financial numbers are under-pinned with operational drivers. Examples of this would be the personnel costs being derived from HR details (by member of staff) and revenue from a driver based sales (quantity x price). As the HR or sales numbers change, the connected financial plan automatically updates.

In our experience progression to this level of maturity is a sign of healthy collaboration between finance and the rest of the business resulting in a willingness to expose more operational details. This is a genuine sign that the business see finance as being potentially helpful when they need to make investments; such as additional marketing spend; to help them keep their forecast numbers. Perhaps this is the start of finance becoming ‘advisors’ rather than ‘policemen’.

The level of complexity continues to increase as more and more of the financial numbers become connected to driver based calculations. This continues until the whole BP&F process models the business; we call this High level connected. An example of this is Sales and Order Processing (S&OP) where there is complete connectivity between all processes, meaning that a change in sales for example will automatically re-plan manufacturing.

In recent years many leading organisations have extended beyond even high level connected BP&F by the use of predictive analytics and decision optimisation. Predictive analytics is being used to provide an informed forecast, of say sales, based on previous data and predicted future events. This use of artificial intelligence takes away the human ‘gut feel’ approach to the future. Decision optimisation is being used by organisations to improve performance by, for example, optimising pricing levels to maximise revenue or profitability.

Currently this is still rare within the organisations that we meet with. There are fantastic examples of the financial benefits that have accrued when finance and operations have combined their knowledge and expertise to create decisions that are best for the business overall. Our favourite is fashion retailer Zara, who contributed and additional £42M net income by collaborating on a decision optimisation solution for store replenishment and clearance pricing.

The role of technology

As the frequency or complexity of your BP&F process increases, there is a threshold beyond which spreadsheets are not able to cope with the needs of the organisation. Our experience is that, for many, the threshold for spreadsheets has been reached and this creates a barrier to them maturing.

There is a point where the use of an enabling technology becomes essential to progress through maturity. Depending upon your specific needs and ambitions, this can range from basic budgeting software ( basic functionality, appropriate for a limited number of users) to enterprise planning software (highly functional, capable of dealing with thousands of users). To reach the highest level of complexity, technology solutions for predictive analytics and decision optimisation are a pre-requisite.

The biggest step, both financially and culturally, is the move away from spreadsheets to an appropriate technology. Whilst this is a daunting step, it is one that needs to be taken to move the organisation forward.

How do you understand where you are in terms of maturity?

At HAYNE we provide a complimentary one day ‘3D Vision Workshop’. During this workshop we will; Discover your needs, Develop the right strategy and then Design the right solution. The outcome of this one day workshop will be a report which clearly identifies your current position and actionable steps to help you work towards a mature your BP&F process.