OneSumX

OneSumX is a suite of risk management solutions provided by Wolters Kluwer.

It is designed to assist financial institutions, including banks and financial organisations, in managing various aspects of risk and compliance. It encompasses a wide range of modules that cover areas such as financial risk management, regulatory reporting, liquidity risk management, credit risk management, operational risk management, and more.

"*" indicates required fields

Features & Benefits

Enhanced Risk Visibility

OneSumX provides a comprehensive view of various risk types, allowing institutions to identify and manage potential risks effectively.

Regulatory Compliance Efficiency

With automated data collection and reporting capabilities, financial institutions can meet regulatory requirements more efficiently and reduce compliance-related costs.

Improved Decision-making

The advanced analytics and modeling tools enable better risk assessment, which leads to informed decision-making at both strategic and tactical levels.

Streamlined Operations

By automating manual processes, OneSumX helps financial institutions streamline their risk management workflows, saving time and reducing operational burdens.

Optimal Capital Allocation

:The platform’s risk assessment and stress testing capabilities aid in optimising capital allocation across the institution’s various business lines and portfolios.

Greater Competitive Advantage

OneSumX enables financial institutions to proactively manage risks and compliance, giving them a competitive edge in the market by fostering confidence among investors, regulators, and stakeholders.

The OneSumX platform aims to help institutions stay compliant with various regulatory requirements, improve risk decision-making, enhance data management, and increase overall efficiency in risk management processes. It provides advanced analytics, reporting tools, and automation capabilities to address the complex and ever-changing regulatory landscape in the financial industry.

Why choose HAYNE Solutions?

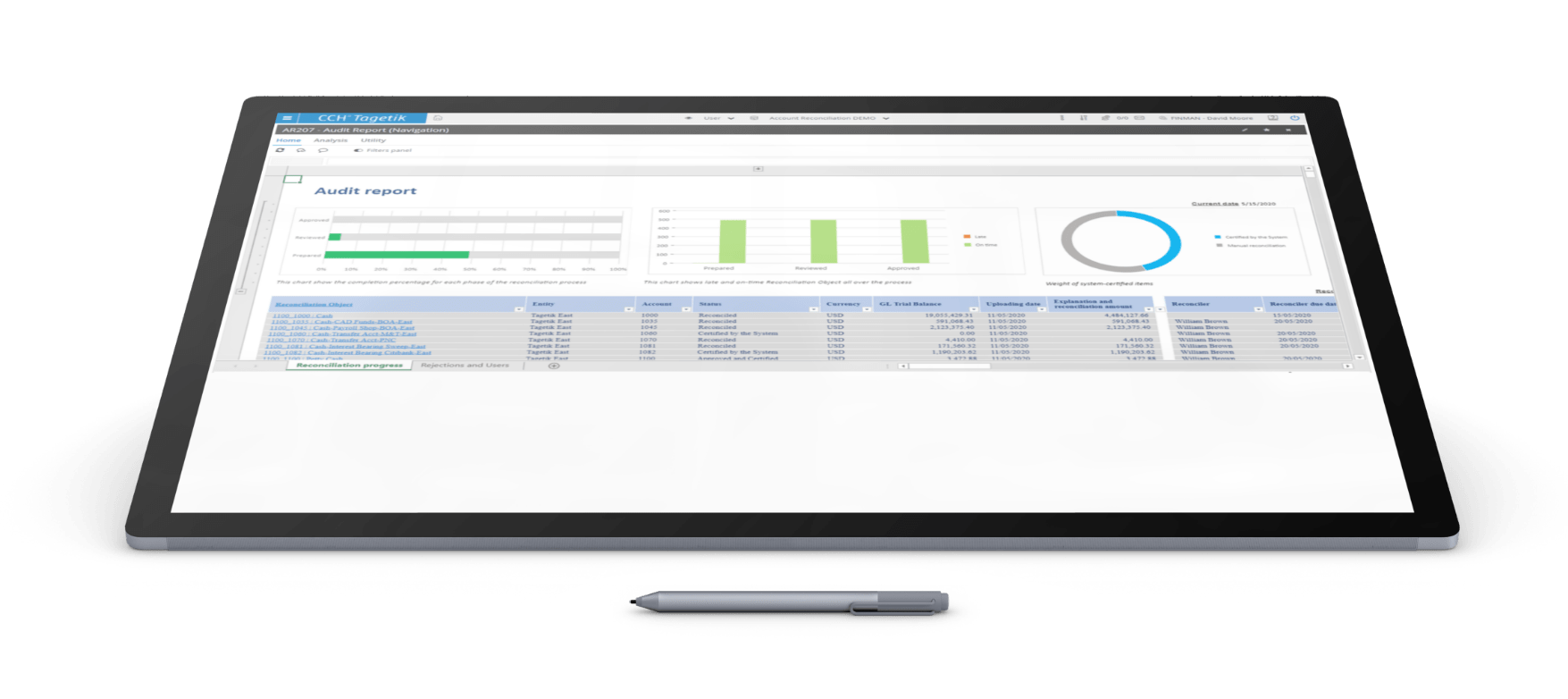

HAYNE are trusted UK CCH® Tagetik Partners with a proven ability in delivering best-in-class solutions

We are your Partner

Our reputation is well-known for our dedication and expertise in delivering best-in-class Enterprise Financial & CPM Solutions – from implementation and licence management to upgrades, training, maintenance and support.

The combination of the HAYNE focus and the strength of CCH® Tagetik delivers results for our clients time and time again. We are certified CCH® Tagetik Developers and can support you with the planning, training and implementation of your CCH Tagetik solution.