Account

Reconciliation

The Future of Account Reconciliation:

Achieve faster, more accurate financial close cycles

Overcoming Challenges for a Higher Quality Close

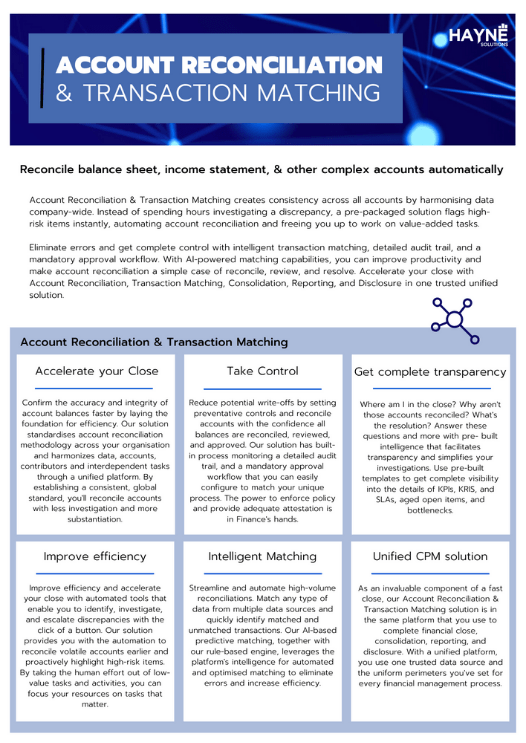

Organisations are starting to face increasing pressure to ensure accuracy, compliance, and efficiency in account reconciliation. Traditional manual methods can be time-consuming, error-prone, and unscalable and so business’ are beginning to look for new ways to enhance accuracy, reduce risk, and ensure compliance.

New compliance requirements like UK SOX necessitate technology-driven solutions to cut through some of the challenges of manual reconciliation by streamlining bank and balance sheet reconciliations, consolidating all key reconciliations and harnessing AI and automation.

The Challenges of Traditional Account Reconciliation

Processes

Time-Consuming Processes

Manual reconciliation requires significant effort, often leading to inefficiencies and delays in financial reporting.

Methods

Error-Prone Methods

Relying on spreadsheets and human input increases the risk of errors, misstatements, and compliance issues.

Standards

Lack of Standardisation

Inconsistent reconciliation processes across different business units can result in discrepancies and audit challenges.

Scalability

Scalability Issues

As businesses grow, the volume of transactions increases, making manual reconciliation unsustainable.

Compliance

Regulatory Compliance

Inconsistent reconciliation processes across different business units can result in discrepancies and audit challenges.

Key Features of implementing an Account Reconciliation Solution:

AI-Powered Transaction Matching

Leverages machine learning to automatically match transactions across multiple data sources, significantly reducing manual effort.

Exception Management

Identifies discrepancies and provides suggested resolutions, allowing finance teams to address issues proactively.

Configurable Workflows

Customisable rules and approval processes align reconciliation practices with business needs and compliance requirements.

Real-Time Reconciliation

Continuous reconciliation throughout the financial period helps avoid bottlenecks at month-end and accelerates close cycles.

Seamless Integration

Connects with ERP systems, general ledgers, and financial databases to create a centralised reconciliation platform.

Audit-Ready Documentation

Ensures full traceability of reconciliations, providing transparent and well-documented audit trails.

Next Steps

Book a discovery Call

Book a call with us and discover how an Account Reconciliation solution can transform Risk Management in Global Accounting.

Why Choose HAYNE Solutions?

Finance-Led Implementation

Our team of financial and lease accounting experts guide you through setup and compliance.

Trusted by Leading Organisation

We work with finance teams across industries to streamline lease accounting processes.

Audit-Ready Transparency

Ensure full visibility of lease obligations with detailed calculations and reporting capabilities.